Accounts

When your end users think about their financial institution, they think about their accounts. Whether it’s deposits, loans, business accounts, or anything in between, accounts are the foundational building block of a user’s relationship with their finances. That’s why Banno Apps are built with accounts in mind. From having quick access to balances to seeing their entire financial history, we make it easy for end users to see what they want, where they want it, whenever they need it.

Account ordering

A seamless experience

When end-users get their accounts set up just right, they want it to stay that way. Banno’s account ordering functionality allows a user-defined account order to be maintained across apps. Whether they’re on mobile or a desktop, they’ll get the same experience every time.

How it works

Navigating to the Organize Accounts screen

There are several ways to navigate to the Organize Accounts screen. The most direct access can be found via the reorder icon on the Accounts card.

An Organize Accounts button can be found at the bottom of the Accounts list. This button only appears if the user has more than one account

Changing the order of accounts

The Organize Accounts screen allows users to drag and drop the bar accounts via the drag icons next to each account as they see fit. The screen displays account details for account name, account number, account holder name, and balance to help differentiate accounts to the end-user. Hidden accounts do not appear within this list. Users can save their order via the Done or arrow button, returning the user to the originating view.

Account orders are saved to the Banno service layer to maintain order across devices. This means a user must be online to save the order of accounts. If the user does not have a connection, an alert prompt will allow the user to cancel their changes or retry.

Account ordering in Enterprise apps

A user’s Overview in Banno Enterprise will display the user’s account list according to the order set by the user. Hidden accounts will appear at the end of the list.

A user’s Accounts screen displays the full list of that user’s accounts, grouped by institution.

Renaming an account

Both retail and business users can rename their accounts at will. End users can do so by selecting their account and selecting the Settings and then selecting the Rename link in the upper right hand corner. This name can be up to 20 characters, consisting only of letters, numbers, and spaces. Special characters are not allowed. This generates a history event for the user, listing both the old and new account name.

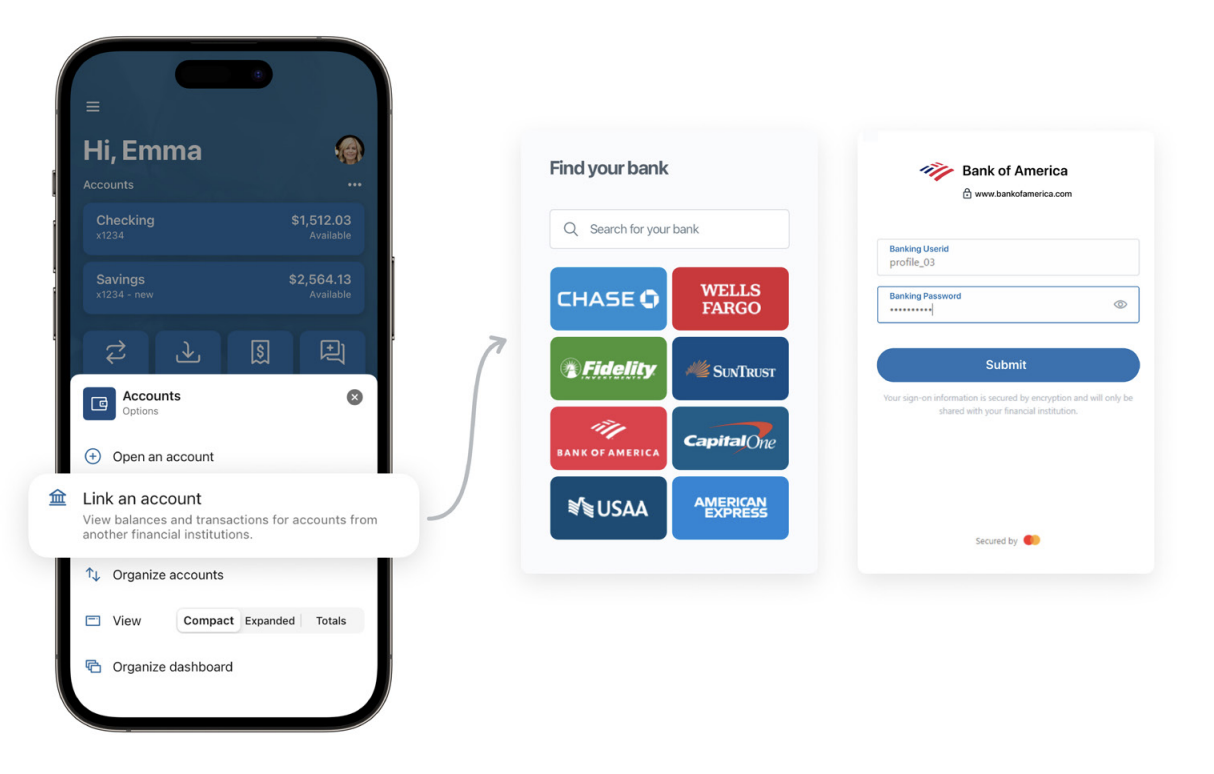

Link an account from another financial institution

When end users link to a third-party account so that it displays in your app, you become the financial hub for your accountholders. Banno Apps natively supports both third-party account connection and personal finance management (PFM) features that position your financial institution at the center of your end users’ financial lives—making your app the first place they go to for checking accounts, reviewing transactions, and managing finances.

If an end user has a third-party account, for example a credit credit card with Bank of America, the end user sees their balance and recent transactions in Banno Apps. The third-party account displays next to their primary accounts at your institution, and their transactions can be viewed in your app.

End users need to re-link their account—or accounts—using the Finicity Connect experience so that new transaction activity continues displaying in their PFM experience. If an account is not linked through the Finicity Connect experience, only historical transactions display.

Account linking details

How does it work?

To add a third-party account, end users link the account to your app by starting the aggregation process from a launch point and successfully completing the Finicity Connect experience.

Once an account is linked, it displays at the top of the Banno dashboard after the end user’s accounts at your institution (1). Linked accounts display as a different color from your institution’s accounts and are ordered alphabetically first by aggregated institution name and secondly by account name. The end user can select the account to review transactions and account details such as the following:

- Type

- The Type of account can include the following:

- 401A

- 401K

- 403B

- 529

- Annuity

- Auto loan

- Brokerage product

- CD

- Checking

- Credit card

- IRA

- Keogh

- Line of credit

- Loan

- Money market

- Mortgage

- ROTH

- Savings

- Student loan

- Variable annuity

- Institution

- The institution name associated with the third-party account.

- Last updated

- The Last updated date is when Finicity last pushed account information. Finicity sends updates to the Banno Digital Platform once a day, and there is not a specific time that Finicity sends the updates. If an end user links an account and there is no activity on the account after linking it, the Last updated date could be the same as the date that they linked to the account in Banno Apps.

When end users link an account, Finicity pulls in the account name assigned by the third-party institution (ex. American Express Platinum Card). Currently, end users cannot nickname third-party accounts in Banno Apps or the Geezeo SSO.

Launch points

End users can add third-party accounts from different launch points in Banno Apps from their Banno dashboard, Accounts dashboard, and profile Settings, as well as in the Geezeo SSO.

In the Banno Platform

There are a handful of launch points in Banno Apps. Launch points might display differently depending on the app (Banno Online or Banno Mobile), other configured integrations, and the end user’s device.

Each Link an account launch point includes the non-customizable description View balances and transactions for accounts from another financial institution.

Banno Apps

- Banno app dashboard

- Link an account

- End user profile menu

- Settings

- Add Account

- Link an account

In Banno Apps, a Link an account launch point displays on the Banno app dashboard and on the end user’s Settings screen.

Banno Online

- Accounts dashboard

- Link an account

In Banno Online, the Link an account launch point displays on the end user’s Accounts dashboard.

Banno Mobile

- menu

- Accounts

- Add account

- Link an account

In Banno Mobile, the Link an account launch point displays as Add Account in the end user’s Accounts dashboard.

In the Geezeo SSO

- Geezeo SSO menu options

- Link Account

- Accounts tile on the dashboard

- VIEW ACCOUNTS >

- Add Linked Account

In the Geezeo SSO, launch points for linking a third-party account display in the Geezeo SSO menu options and the end user’s Accounts screen.

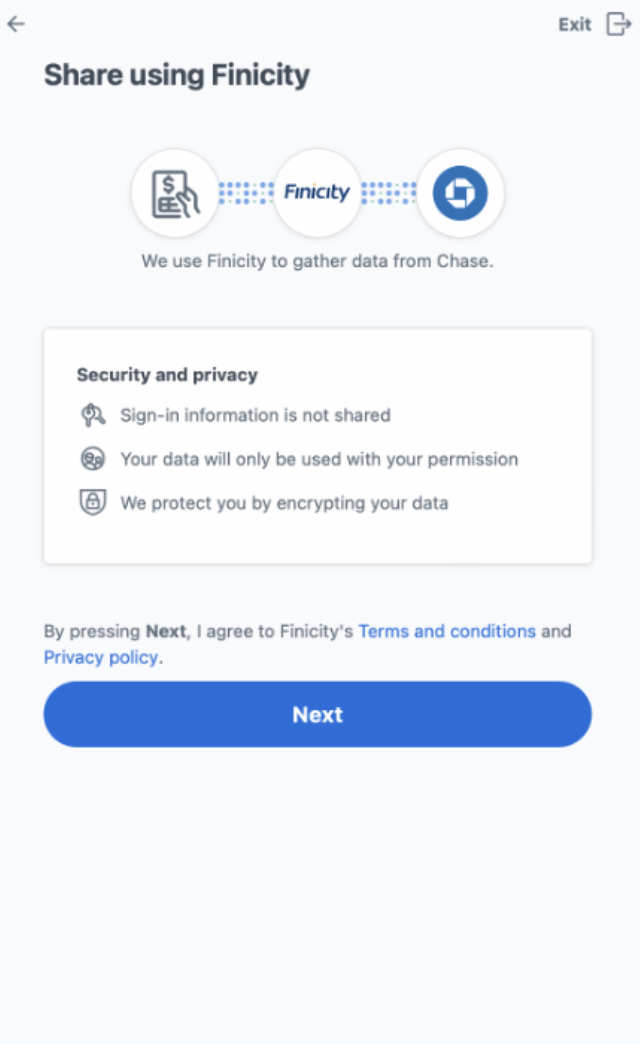

Finicity Connect experience

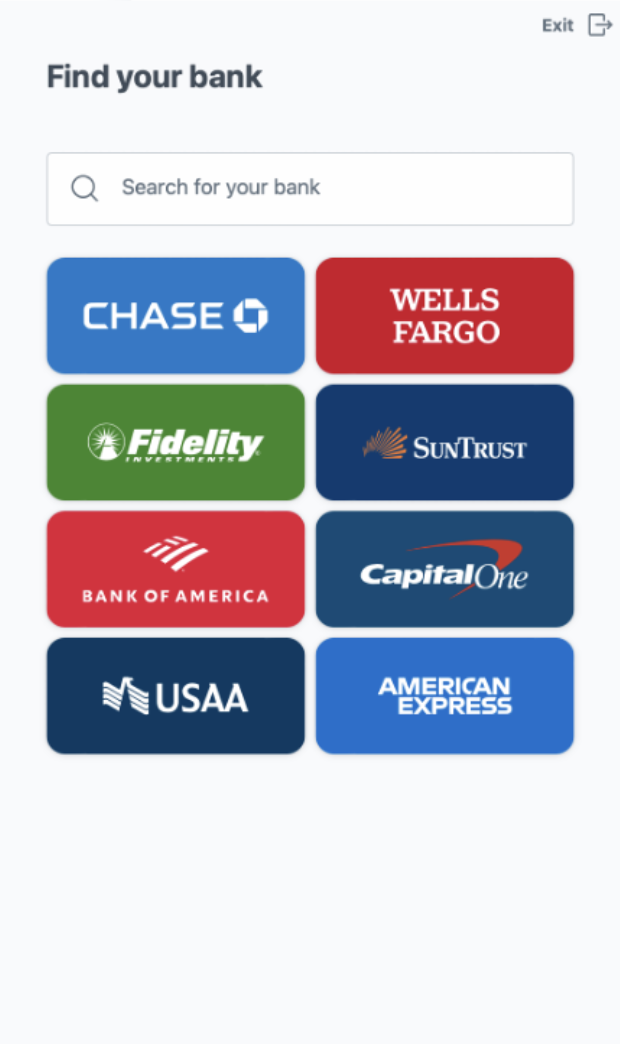

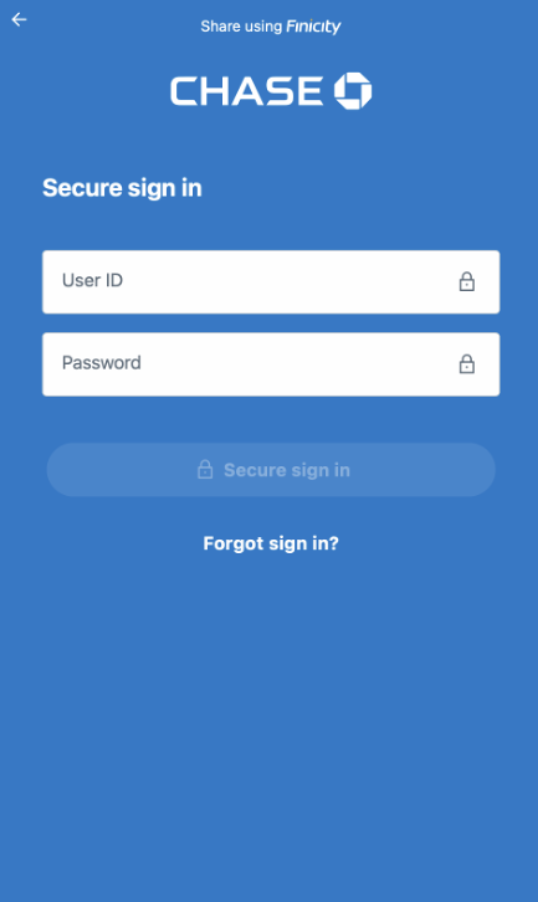

In partnership with Finicity, one of Banno’s integrated data aggregators, the end user needs to successfully complete the Finicity connect experience to link an account. Aggregating third-party accounts in to Banno Apps is controlled by Finicity, and the Finicity Connect experience walks end users through finding and logging in to their third-party account.

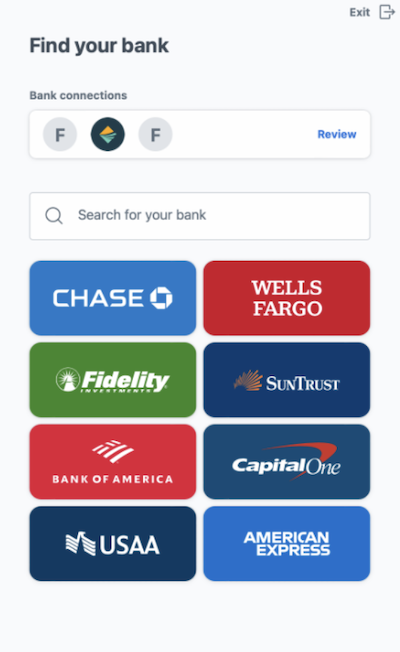

When the end user clicks a launch point, the Link an account window displays (1) a list of eight default institutions for the end user to choose from. They can also search for an institution using the search bar. If an end user doesn’t see the financial institution they’re looking for, your institution can open a Support ticket with Banno via the ForClients portal and note the financial institution to add. Our team will work with Finicity to add support for that financial institution.

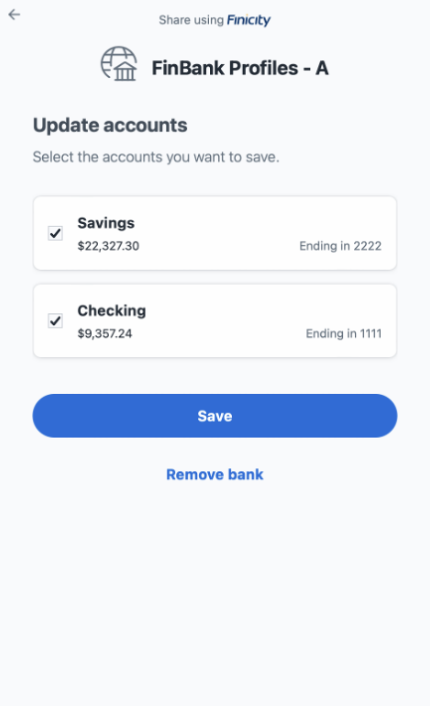

After selecting their financial institution, the end user reviews their institution and accepts Finicity’s terms and conditions (2). Once the terms and conditions are accepted, the end user logs in to their account using the institution’s authentication requirements (3).

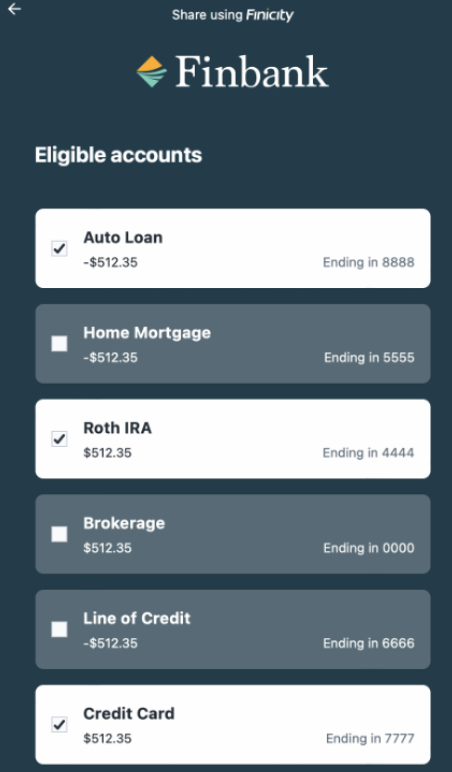

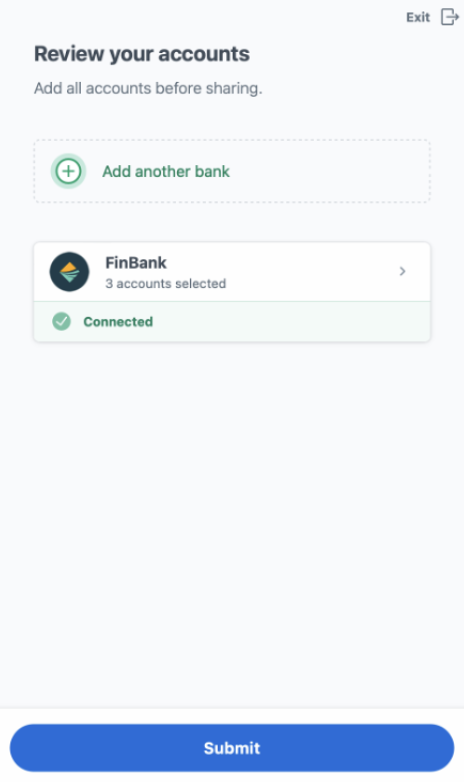

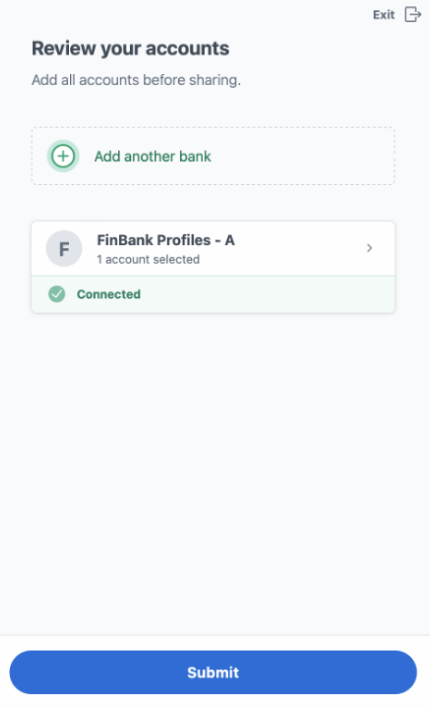

After the end user logs in to their financial institution, they select the accounts they want displayed in Banno Apps and click Submit. (4) While an eligible account might display with a nickname (ex. business expenses), the assigned account name (ex. American Express Platinum Card) displays after it is linked. After the end user selects the accounts they want to aggregate, they can add another institution or review the selected accounts and Submit the accounts (5).

Depending on where the end user starts the aggregation process, they automatically return to the Banno app or Geezeo SSO. After finishing the Finicity Connect experience, it may take time for linked accounts or updated institution information to display in Banno Apps.

When initially linked, Banno Apps and the Geezeo SSO display 180 days of transactions from the date an end user linked the account.

Posted transactions—not pending–display in both Banno Apps and Geezeo.

When an end user links an account from another Banno institution they may receive an email notifying them that they logged in from another device. The device also displays under the end user’s Devices in their security settings. This issue will resolve itself as Finicity works toward being fully API-integrated.

Review or remove a third-party account or institution

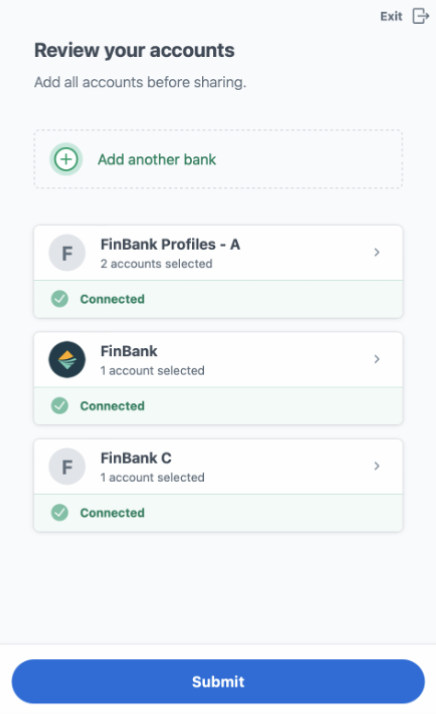

To manage a linked account or connected institution, the end user clicks one of the launch points and the Link an account window displays the list of default institutions for the end user to choose from (1). At the top of the window displays a current list institutions with the end user’s linked accounts. The end user clicks the Review button where they can review and/or remove an account and/or the institution (2).

After the end user clicks the Review button they can go in to individual financial institutions to review accounts (3), remove accounts or the institution (4), and submit updates (5).

Add an account

If an end user has already linked an institution and wants to add a new or different account, they need to complete the aggregation process described in the Finicity Connect experience.

Search and filter accounts

Searching and filtering for both third-party accounts and third-party transactions is unavailable in Banno Apps. Also, third-party transactions do not display in the Transactions card that displays on the app dashboard.

Geezeo SSO

Third-party accounts aggregated in Banno Apps or in the Geezeo SSO display in both applications regardless of where the end user completes the Finicity Connect experience. In the end user’s Accounts screen, a collection of Active and Inactive accounts display alongside the end user’s accounts with your institution.

- Active

- Active is a collection of accounts in an open state at a financial institution. Transaction activity and balance updates display. Accounts that display in the Active collection display in Banno Apps.

- Inactive

- Inactive is a collection of Closed, Archived, and active accounts that are no longer used in the PFM experience.

Closed

An institution closes an account (primary at your institution or third-party), or an end user removes a third-party account using the Finicity Connect experience. Historical transactions display and the third-party account can still be used in the PFM experience, for example in the Budget details. If the end user removes the third-party account and then chooses to re-aggregate it, the end user links to the third-party account through the Finicity Connect experience. The third-party account will then display in the Active account collection.

If an end user removes the third-party account using the Finicity Connect Experience and then re-aggregates it, the third-party account displays as a newly added account in the Active account collection.

Archived

The end user archives the third-party account, and historical transactions do not display and the account can no longer be used in the PFM experience. If the end user chooses to re-aggregate the account, the end user links to the account through the Finicity Connect experience. The account will then display in the Active account collection.

If an end user re-aggregates an archived third-party account, it displays as a newly added account in the Active account collection.

Unused active accounts

An end user disables the third-party account from using it in the PFM experience. In the Edit Account details screen, the end user selected which PFM account details can be used. By default, third-party accounts have Include this account in all features checked. If the end user customizes the account details and unchecks Include in Dashboard, the account displays in the Inactive account collection regardless of third-party account state. Depending on other selected account details, the third-party account may or may not be used in the PFM experience, and historical transactions may or may not display. If the end user re-enables the third-party account for use in the PFM experience, it displays in the Active collection.

An unused active account can also include when an end user removes a third-party account using the Finicity Connection experience.

If the end user re-enables the third-party account for use in the PFM experience, it displays in the Active collection.

2FA authentication

If an end user is on an iPhone or iPad and prompted to use 2FA for authentication in the Finicity Connect experience, they may be unable to link the account from the Geezeo SSO. Because they have to leave or background the Banno app to view the 2FA code, the Geezeo SSO closes. They will need to link the account from Banno Apps.

Manage linked accounts at an institution

End users can view a complete list of third-party accounts in their profile Settings menu or a third-party account’s Settings. They can also manage third-party accounts from a Finicity Connect experience launch point.

Error states

Because the Finicity Connect experience manages account aggregation, any error message that displays in Banno Apps is their error message. Two of the most common error states include Sign in required and Institution connection error.

Sign in required

If an end user can correct the linking issue, Banno Apps displays Sign in required and guides end users to sign in. In most cases, this error state is due to an invalid username and/or password. The end user clicks the Sign back in button and is prompted to re-establish connection by re-entering their institution’s login credentials, answering a security, etc., which is similar to how they authenticate when they first link an account.

Institution connection error

If Finicity is unable to connect to the end user’s financial institution, the error message Institution connection error may display. In most cases, the end user should re-check their linked accounts at a later time.

Banno Admin

- Banno People

- Users

- select user

- Accounts

In the end user’s profile, linked accounts display alongside the accounts at your institution. Admin users can also view transactions and details associated with linked accounts, as well as error states that might occur.

View hold amounts

Whether for transfers or payments (or anything in between), it’s not uncommon for an end user to have a hold on their account. Unfortunately, it can be tricky to accurately reflect holds in that user’s available balance. But tricky has never been an issue for us. Using the abilities of your core, Banno Apps give your institution the power to determine the types of holds that should be applied to your end users’ available balance. It just requires a little bit of configuration on your core.

Hold amount details

Configuration

Configuration must be done via your standard core configuration, and varies depending on your institution’s core.

Silverlake

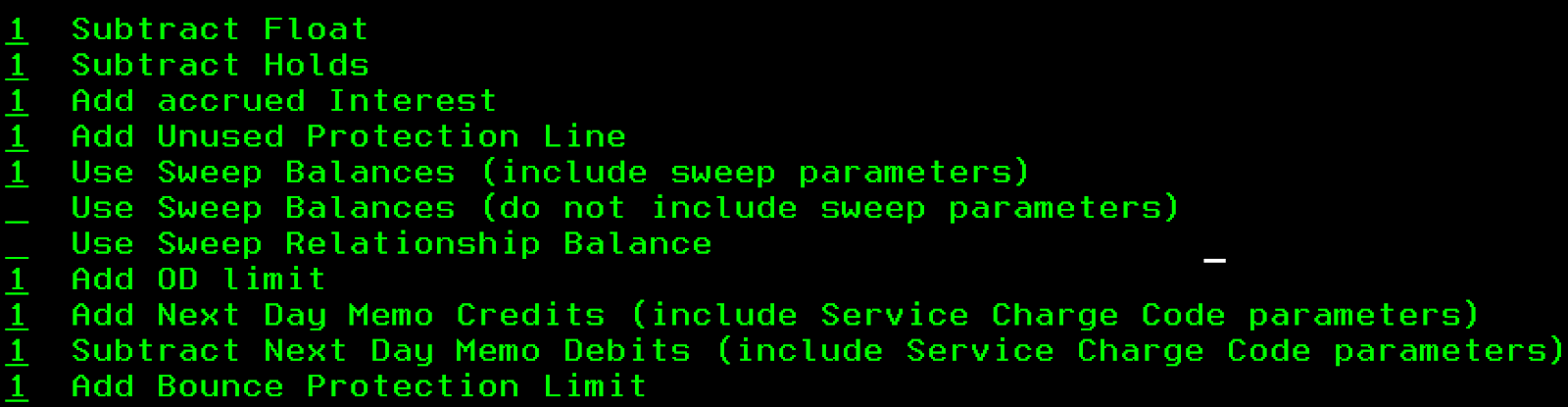

Using the available balance calculation table configured within the Silverlake core (DDPAR option 40), the following fields appear in Banno’s balance info dialog if the account balance is affected by one of the following fields.

CIF 20/20

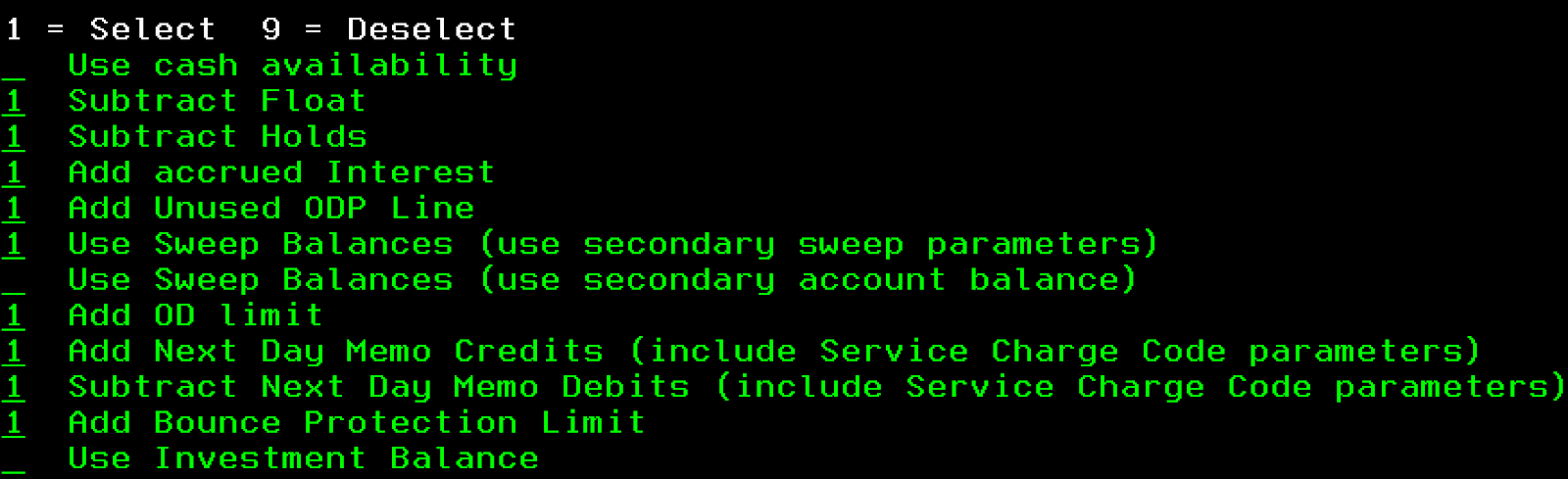

Using the available balance calculation table configured within the CIF 20/20 core (DDPAR option 27), the following fields appear in Banno’s balance info dialog if the account balance is affected by one of the following fields.

Transactions

Each account is associated with some number of transactions, but the interactions can be pretty complex. For more information, check out our transactions guide.

FAQ

FAQ: Accounts

- Can an end user hide an account from their Accounts list?

- Yes, to hide an account and its activity from display, the end user can select Settings for the desired account and toggle Display in online and mobile banking.

- How does an end user re-display an account once it’s hidden?

- Select user profile menu Settings Select institution Select account Toggle Display in online and mobile banking.

- How do Banno Apps handle users with many accounts?

- Banno has special functionality for users with over 20 visible accounts. For more information, see our transactions guide.

- What types of account balances display to end users?

- Depending on the account type (checking, credit, CD, etc.), up to two account balances can display, including Available Balance, Current Balance, or Collected Balance.

If an institution chooses to display two account balances, the following options are configurable:

- Available Balance and Current Balance

- Available Balance and Collected Balance

The balance display config options are for checking/savings/club accounts only.

FAQ: Account Linking

- Is there an additional cost for third-party account connection?

- Yes, this feature is an additional cost. Please contact your sales rep for more information.

- Which institutions are supported by Finicity for third-party account connection?

- You can view a full list of supported financial institutions at Finicity’s website. If you don’t see the supported financial institution you’re looking for, please open a Support ticket with us via the ForClients portal and indicate which financial institution you’d like added. Our team will work with Finicity to add support for that financial institution.

- Does third-party account connection work for Banno Business end users?

- Third-party account connection is available for both retail and Banno Business end users. That said, if one end user of an organization account connects third-party accounts via Finicity, those third-party accounts will only be visible to that end user not the entire organization.

One reason we love partnering with Finicity is that they have more advanced business and commercial solutions, and we’re already planning for how those features will impact your Banno Business™ accountholders beyond third-party account connection.

- Do institutions have access to the data for connected accounts?

- At launch, you will be able to see the third-party connected accounts and transactions on an accountholder’s profile within Banno People™, and we’re already working on an interface to view aggregated data analytics across your accountholders.

This data is also accessible via our API gateway.

Please note that we have no plans to provide raw data access from third-party connected accounts.

- How does third-party account connection work for Geezeo customers with CashEdge?

- If third-party accounts have been connected in Geezeo through CashEdge, those accounts will need to be re-connected (aggregated) in Banno’s interface through Finicity. One benefit of the need to re-connect accounts through Finicity is that Finicity’s connection has both access to more financial institutions than CashEdge, as well as support for OAuth 2.0, the latest security standard.

- How does third-party account connection work with currently linked accounts for external transfers?

- This will not have any impact on accounts that are currently linked in Banno for external transfers. Those accounts are simply linked only for transfer purposes, and end users have never been able to view any account activity for these types of linked accounts.

If an end user wishes to view account activity for a third-party account they already have linked in the External Transfers area of Banno, they will also need to connect that account in the Accounts area of Banno.

- Can an institution disable third-party account connection?

- There is not currently a setting in Banno Admin to control access to the feature. The Banno team can work with an institution to override it if needed.

- Can institutions customize the third-party account’s card color that displays on the Banno dashboard?

- The card color cannot be customized. The color is a default, neutral shade of grey that is part of your institution’s theme.

- In the Finicity Connect experience, can an institution customize the list of eight default third-party institutions that display in the “Find your bank” screen?

- If an institution wants to modify the default list of institutions, they can by contacting the Banno or Geezeo support team. This ticket is then submitted to Finicity via the Geezeo support team.

- What types of third-party accounts can be linked?

- Here are the account types that Finicity aggregates. The

typefield displays the list of supported account types. - What is the difference between having Finicity as a data integration partner (and utilizing external applications) and using Finicity as part of the Geezeo PFM experience?

- Our data integration partnership with Finicity allows them to securely pull end user information from Banno Apps to display in a third-party application. The Geezeo PFM experience allows Finicity to securely pull an end user’s account information from third-party institutions to display in Banno Apps.

- Why would the last updated date change for a third-party account when there has been no balance changes or new transactions associated with the account?

- Finicity sends updates for an account when changes occur to any of the following fields:

- Account number

- Account nickname (name assigned by account owner)

- Balance

- Status (the state of the account in the Finicity system—active / pending / deleted)

- Aggregation status code (the status of the account connection between Finicity and the financial institution)

- Can accountholders use Finicity to link additional accounts from the primary financial institution?

- To add addtional primary accounts from the accountholders bank or credit union, it is recommended that the accountholder work directly with their financial institution.

FAQ: Hold Amounts

- Which balance details are not reflected in Banno’s balance info dialog?

- Currently, we do not display the following balance details:

- Investment balance

- Memo credit amount

- Memo debit amount

- Use Cash Availability (CIF 20/20)