Transactions

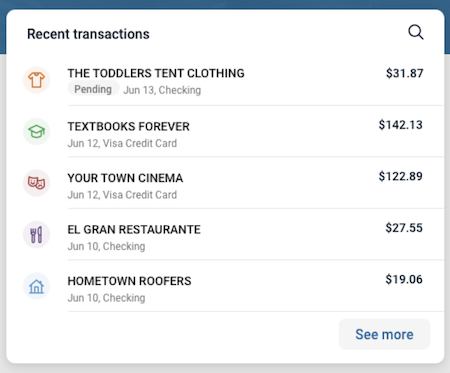

Your end users want to know where their money is going. It’s common sense, and Banno’s robust transaction features help ensure those end users have the best view possible. Whether they’re looking for a specific transaction or trying to remember why they spent four hundred dollars on shoes last month, Banno apps will be their best ally in keeping a grip on their finances.

How many transactions does Banno pull for an account?

Banno Apps pull 500 transactions at a time per account. Mobile caches the transactions retrieved the last time the end user used the app, allowing for quicker access to transactions as far back as the end user has used Banno Apps.

What time frame does Banno pull for displaying a transaction history to end users?

End users can click the See more button to incrementally pull seven days worth of transactions into Banno Apps. If transactions reach 180 consecutive days of inactivity, End of available activity displays in Banno Online while Banno Mobile end users reach the end of their transaction history.

Users with many accounts

Provided an end user has 20 or fewer accounts, Banno Apps function exactly how you’d expect—down to displaying a bird’s-eye view of all transactions for all accounts, grouped in a single, comprehensive transactions card. Once an end user has 21 or more accounts, viewing all transactions for all accounts is disabled to ensure the speed and stability of the app. End users must view transactions for each account individually, and transaction searches must be performed on a single account at a time.

Note that this limitation only affects visible accounts—that is, those accounts that have the Account Setting Show balance and activity (Mobile) or Display activity and transactions (Online/People) enabled. Hidden accounts do not apply toward the 20 account threshold, and hiding accounts can bring an end user back below this threshold.

Print or download transaction activity

At the top of the Transactions list on an account’s dashboard, end users can click to print the Transactions list or to download transaction activity. When an end user downloads transaction activity, they’ll select a date range and file type to export. For a file type, end users can choose to export a CSV spreadsheet, a text file, or an Open Financial Exchange file.

Transaction Enrichment

There are two experiences for transaction enrichment in Banno: Native Banno Enrichments and OFM Enrichments, both of which are described below.

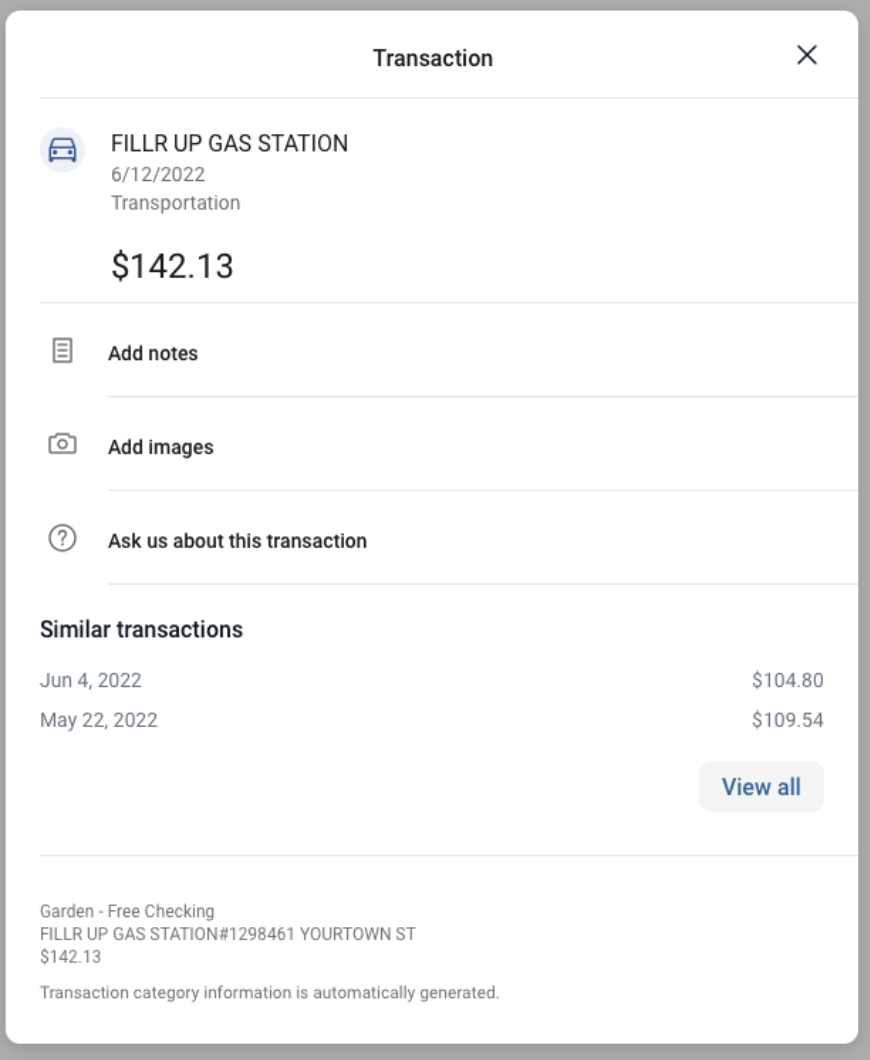

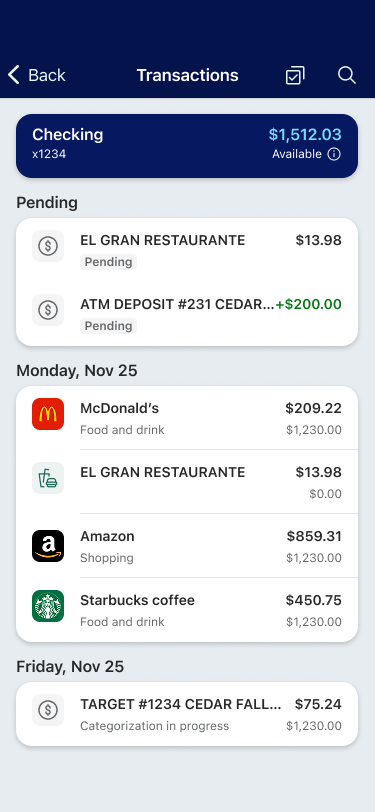

Native Banno Enrichments bring a modern and user-friendly transaction experience to the main transactions page, right where users expect it! Leveraging Bud Financial’s enrichment engine, Banno can enrich your retail accountholders’ transactions and display the enriched data directly within their Banno Apps UI. Transactions enriched by Bud through Banno identifiy a merchant, adding that merchant’s name to the transaction description and displaying a logo, if available. If the merchant’s logo is unavailable, the icon will instead show the transaction category the transaction falls into. If a transaction cannot be enriched for any reason, the original memo is still displayed to the accountholder.

Native Banno Enrichment example

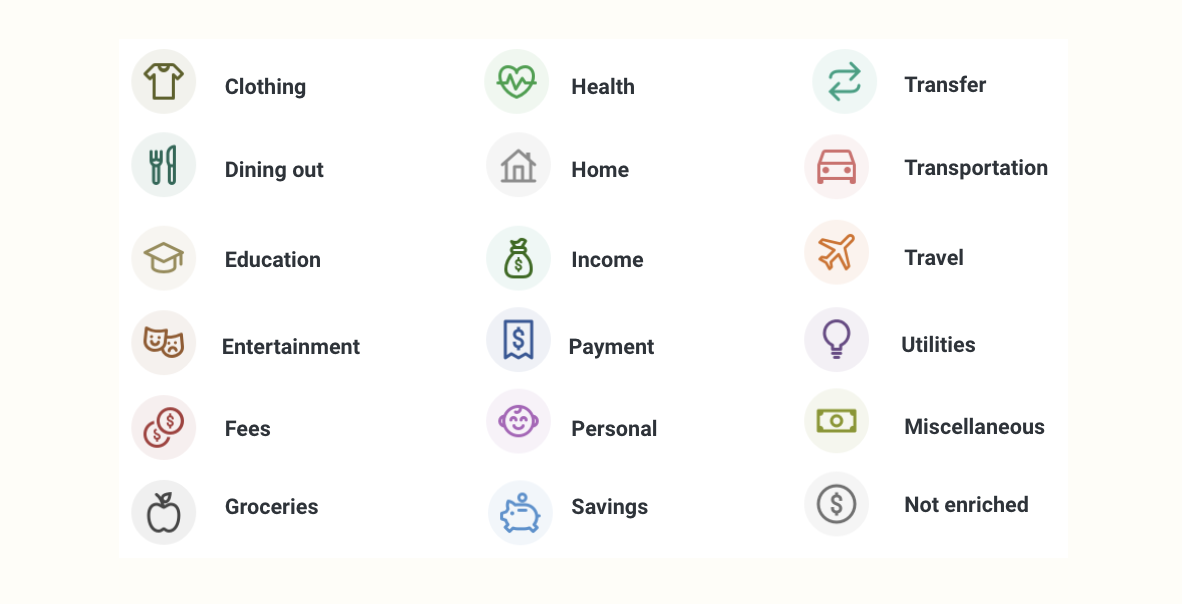

Spending categories

As the enrichment engine processes a transaction, it assigns the transaction one spending category from a list of predefined categories. Each category has specific icon associated with it that cannot be customized. The category icon also correspond with the spending wheel in the Spending by category dashboard card so the end user can review their spending habits.

Editing an enrichment

Accountholders and admin users in Banno People can edit the enrichment details for a given transaction, including merchant name and category, by selected the Edit details option for a given enriched transaction. Changing a merchant name replaces the icon on the transaction with the most relevant icon available.

Spending by category dashboard card

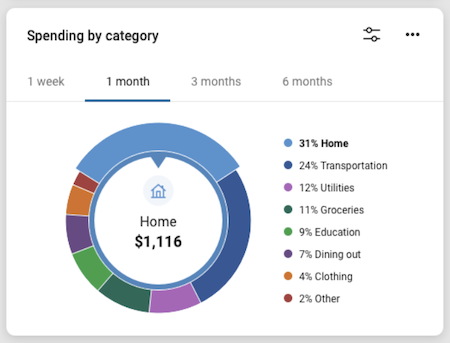

The Spending by category dashboard card displays in Banno Online is available to all institutions. It offers a detailed overview of how an end user spends their money, allowing them to analyze where they spent their money over the last week (past 7 days), last month (past 30 days), three months (past 90 days), or six months (past 180 days). Each time the end user logs in to Banno Apps, the Spending by category dashboard card automatically syncs the end user’s accounts to display the transaction information by time frame and category. They can also select if they want to view their spending in a chart or list format.

Enriched transactions are summarized by category in a spending wheel in the user interface (UI). This includes all transactions enriched by Bud and replaces the Geezeo spending wheel for those who previously had Geezeo’s wheel enabled.

As we focus on our native apps, we will take advantage of the icons inherent within the operating system — starting with Apple’s SF Symbols in Banno Mobile 3.31 — and are making efforts to align these as closely as possible to our web-based icons. You can see a preview of these updates on the iOS App UX Evolution page.

OFM provides Financial Health insights via a a focused customer engagement screen that brings together enrichment with other financial health tools. Using Geezeo’s enrichment engine, Banno Apps gives end users the ability to organize their purchases and improve their financial health. By default, a spending category is automatically assigned to each transaction, as well as a cleansed memo, so that end users gain a better understanding of their transactions. A corresponding Spending by category card-–designed to look like a spending wheel—also displays on the Banno dashboard for end users to view their spending across all categories.

Spending categories

As the Geezeo enrichment engine processes a transaction, it assigns the transaction one spending category from a list of 18 different predefined categories. Each category has specific icon and color associated with it that cannot be customized. The color and category icon also correspond with the spending wheel in the Spending by category dashboard card so the end user can review their spending habits.

If the enrichment engine is unable to enrich a transaction or there is an error in the process, the Not enriched spending category assigns to the transaction and defaults to display the memo description that core returns.

Change spending category

For institutions contracted for Geezeo, end users can change the default spending category or add a custom spending category within the Geezeo SSO. If a spending category is changed to another pre-existing default spending category, the transaction updates and displays the same in Banno Apps. If a spending category is changed to a custom category, the change displays as Miscellaneous in Banno Apps.

Edit transaction name

For institutions contracted for Geezeo, end users can edit the transaction name—also known as the memo—within the Geezeo SSO. These changes display in the Geezeo SSO, but will display differently in Banno Apps. If the end user edits the transaction name, the name will not display in Banno Apps—we’re working to bring the same functionality to Banno Apps.

Legacy tags

Considerations for institutions that pre-date transaction enrichments

If your institution started using Banno before we enabled transaction enrichments, it’s important to understand that enrichments impact the user experience. Before Banno Apps automatically provided transaction enrichments, end users had the option to add categorical tags to their transactions. Now that we utilize automatic transaction categorization, which began with Banno Mobile™ version 3.0, legacy tags are no longer supported.

After we enable transaction enrichment, end users can no longer add new tags or change tags but they can still view and search tags that they previously added. This functionality applies to Banno Online only as legacy tags will be removed altogether from Banno Mobile. End users who utilized legacy tags will be glad to know that our future plans for transaction enrichment involve adding even more categories plus allowing accountholders to customize their own.

Activity views and details

When an end user views their Transactions or All activity, the spending category icon displays on the furthest left-side of the transaction, with the merchant and date next to it. At the bottom of the transaction details, a transaction title—also known as the memo—from core displays, as well as the text Transaction category information automatically generated. The same default transaction details display as prior to enabling transaction enrichment.

Spending by category dashboard card

The Spending by category dashboard card displays in Banno Online. It offers a detailed overview of how an end user spends their money, allowing them to analyze where they spent their money over the last week (past 7 days), last month (past 30 days), three months (past 90 days), or six months (past 180 days). Each time the end user logs in to Banno Apps, the Spending by category dashboard card automatically syncs the end user’s accounts to display the transaction information by time frame and category. In the card, an end user can filter which accounts to view their spending habits. They can also select if they want to view their spending in a chart or list format. For institutions contracted with Geezeo, end users can interact with the spending wheel in the SSO for further understanding of their purchase history.

Banno People

- Banno People

- Users

- select user

- Accounts

In Banno People, admin users view the same spending category icons and cleansed memos as the end user in Banno Apps. For institutions contracted for Geezeo, admin users are unable to view changes that an end user makes in the Geezeo SSO. We’re working to bring the same functionality to Banno People.

Loan payment breakdown

Our loan payment breakdown functionality makes loan payment transactions simpler for Symitar and SilverLake customers. It consolidates all information about the payment to a single transaction while providing additional information about the payment, putting your end users’ most important information at their fingertips. To get started, simply open a support case!

In the past, Banks would sometimes see multiple transactions related to a single loan payment. This new ability condenses those transactions into a single transaction containing the following information, including new information for both banks and credit unions.

Banks

A new breakdown is shown for all loan payment transactions, except those going entirely toward the principal amount. The following fields appear, if applicable to the given payment:

- Principal

- Interest

- Escrow

- Late Charge

- Unapplied Funds

- Other Charges/Fees

Please note that the loan payment breakdown may have interactions with any transaction filtering your bank has configured. Most importantly, if your bank is configured to filter out the primary loan payment transaction, this transaction will not show in your end users’ apps. Transaction filtering will still apply at the transaction level, but will not be accounted for at the payment breakdown level.

Credit Unions

A new breakdown is shown for all loan payment transactions, except those going entirely toward the principal amount. The following fields appear, if applicable to the given payment:

- Principal

- Interest

- Escrow

- Fee

- Billed Fee Amount

- Sales Tax Amount

- Late charge waived

EDI transaction details

EDI is the standard for inter-company communication of business documents. This is especially important for Banno Business users, who often require this format for purchase orders, invoices, and more. Banno apps provide available EDI data for posted transactions on CIF 20/20 and SilverLake, once configured and activated.

Transactions with available EDI data show EDI Transaction beneath the memo in the transaction list. These transactions are identified at login and added to the eligible transactions when the transaction list is updated. Once a transaction with EDI data is identified, navigating to the Transaction details screen shows a Download EDI information option. This initiates a download of a detailed file with all EDI data for the selected transaction, and is available for both pending and posted transactions.

FAQ

FAQ: Transactions

- Why does search exclude some transactions for some users?

- Since Banno Apps only displays 500 transactions a time, end users with higher transaction volumes may need to click Search further back (Online) or See more (Mobile) to see all transactions associated with a given date. There are plans to continue improving search functionality for users with many accounts or transactions. For more information, see our public roadmap.

FAQ: Transaction Enrichment

- Are category icons and colors customizable?

- Category icons and colors are designed by default and cannot be modified.

- Why does the spending wheel display the same data for different time periods that are selected (one week vs six months)?

- The spending wheel is not compatible with transactions that pre-date the transaction enrichment feature. Therefore, if the end user selects a time period that started before Banno Apps automatically enriched transactions and a second time period that started afterward, the spending wheel will display the same data—i.e. the enriched data—for both durations. End users should be advised that this type of duplicate data (for separate time periods) indicates the need to select a shorter time period. This limitation will not be an issue once there has been six months of transaction enrichment (the longest time period on the spending wheel).

- Does the transaction enrichment feature use third-party services and machine-learning?

- Yes. Here are the details you need to know:

- The transaction enrichment feature within the Banno Digital Banking Platform incorporates third-party services, including those owned and provided by Bud Financial, Inc. (“Bud Financial”). Jack Henry reserves the right to replace Bud Financial with a similar vendor at any time, in JH’s sole discretion, without notice to customers.

- Bud Financial’s categorization capabilities for transaction enrichment uses machine learning (“ML”) technologies (the “Model”). The Model uses a combination of natural language processing (“NLP”) and supervised ML methodologies to create a neural network that can categorize transactions.

- The Model works by dissecting all information in the transaction description to pick up nuances such as the difference between “7-eleven” being relevant for convenience stores but “7-eleven gas” being relevant for transport (i.e. a $50.28 transaction), or depending on the value of the transaction convenience stores (i.e. a $2.50 transaction). The Model also returns a confidence value associated with each predicted category. Where the Model does not have sufficient confidence in a prediction, Bud Financial will “threshold” this prediction as not having high enough confidence it is a certain category and return a “general” category.

- Neural networks help the Model adapt to changing descriptions, categorize new merchants, handle complex transaction patterns and edge cases, and improve the detail of the categorization system.

- De-identified customer data may be used by Bud Financial to improve the transaction enrichment feature. For example, when Bud Financial is informed of a correction to a transaction’s categorization, Bud Financial may use that de-identified customer data to apply a change.

- The customer is responsible for its own model of risk management program in accordance with applicable regulatory guidance.

- How does entity extraction (memo cleaning) work?

- The entity extraction Model looks specifically at the transaction description and works to determine what valuable information can be garnered from the description. It identifies the parts of the text that are in each of the following categories: merchants, processors, names, transaction types, dates, and locations.

The Model uses a combination of NLP techniques, including the use of Bud Financial created non-generative language models to identify merchants that have never been seen by the Model before, as well as distinguish between the same entity acting in different capacities: e.g. payments to PayPal (merchant) versus payments via PayPal (processor). This is the case even if the text for the entity is the same in both transactions. To return a clean and consistent enrichment, the output of the entity extraction is passed to further matching services to complete the merchant, processor, and location outputs.

- How does merchant and processor matching work?

- The Model compares extracted merchant and processor data against its merchant database of known merchants to provide merchant and processor matching.

The Model’s merchant database uses complex matching techniques to identify candidate merchants for tokens and retrieve a confidence in this prediction. The merchant database automatically adds the highest confidence predictions, and Bud Financial manually reviews lower confidence predictions with human oversight.

- How does merchant location matching work?

- The Model determines a merchant location using transaction descriptions and merchant details and matching those details against its location database. It relies solely on merchant related location data and does not use any end user’s location data.

- What does the user experience look like for transaction enrichment?

- The transaction enrichment feature is embedded in the end user’s online banking experience. The end user does not log into a separate platform or accept any end user license terms with Bud Financial directly.