View hold amounts - Banks

Whether for transfers or payments (or anything in between), it’s not uncommon for an end user to have a hold on their account. Unfortunately, it can be tricky to accurately reflect holds in that user’s available balance. But tricky has never been an issue for us. Using the abilities of your core, Banno Apps give your institution the power to determine the types of holds that should be applied to your end users’ available balance. It just requires a little bit of configuration on your core.

Configuration

Configuration must be done via your standard core configuration, and varies depending on your institution’s core.

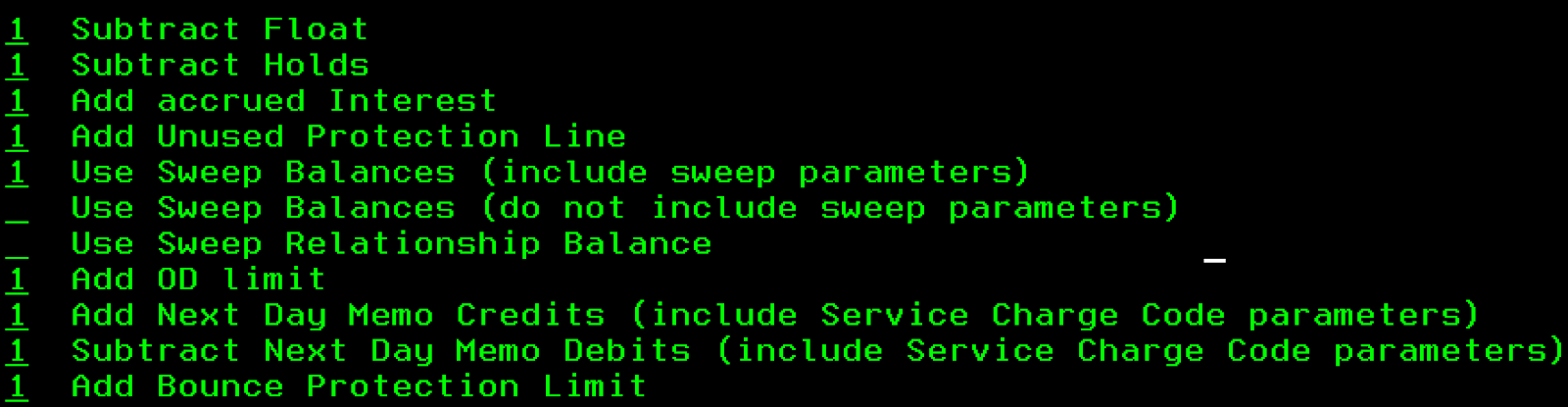

Silverlake

Using the available balance calculation table configured within the Silverlake core (DDPAR option 40), the following fields appear in Banno’s balance info dialog if the account balance is affected by one of the following fields.

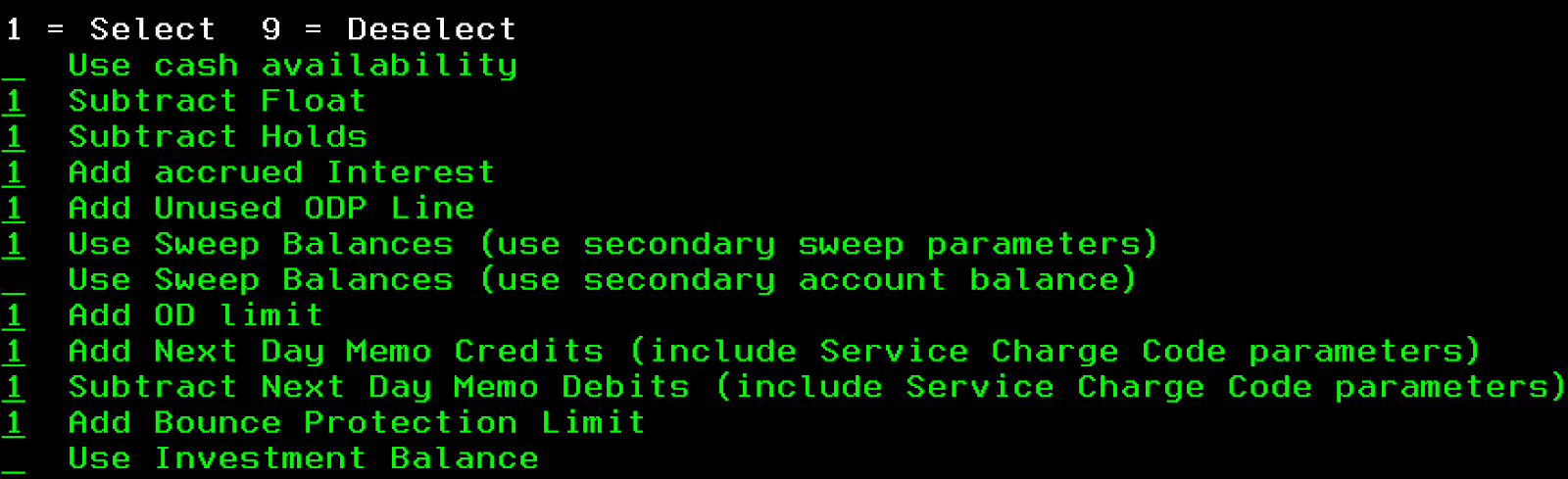

CIF 20/20

Using the available balance calculation table configured within the CIF 20/20 core (DDPAR option 27), the following fields appear in Banno’s balance info dialog if the account balance is affected by one of the following fields.

FAQ

- Which balance details are not reflected in Banno’s balance info dialog?

- Currently, we do not display the following balance details:

- Investment balance

- Memo credit amount

- Memo debit amount

- Use Cash Availability (CIF 20/20)